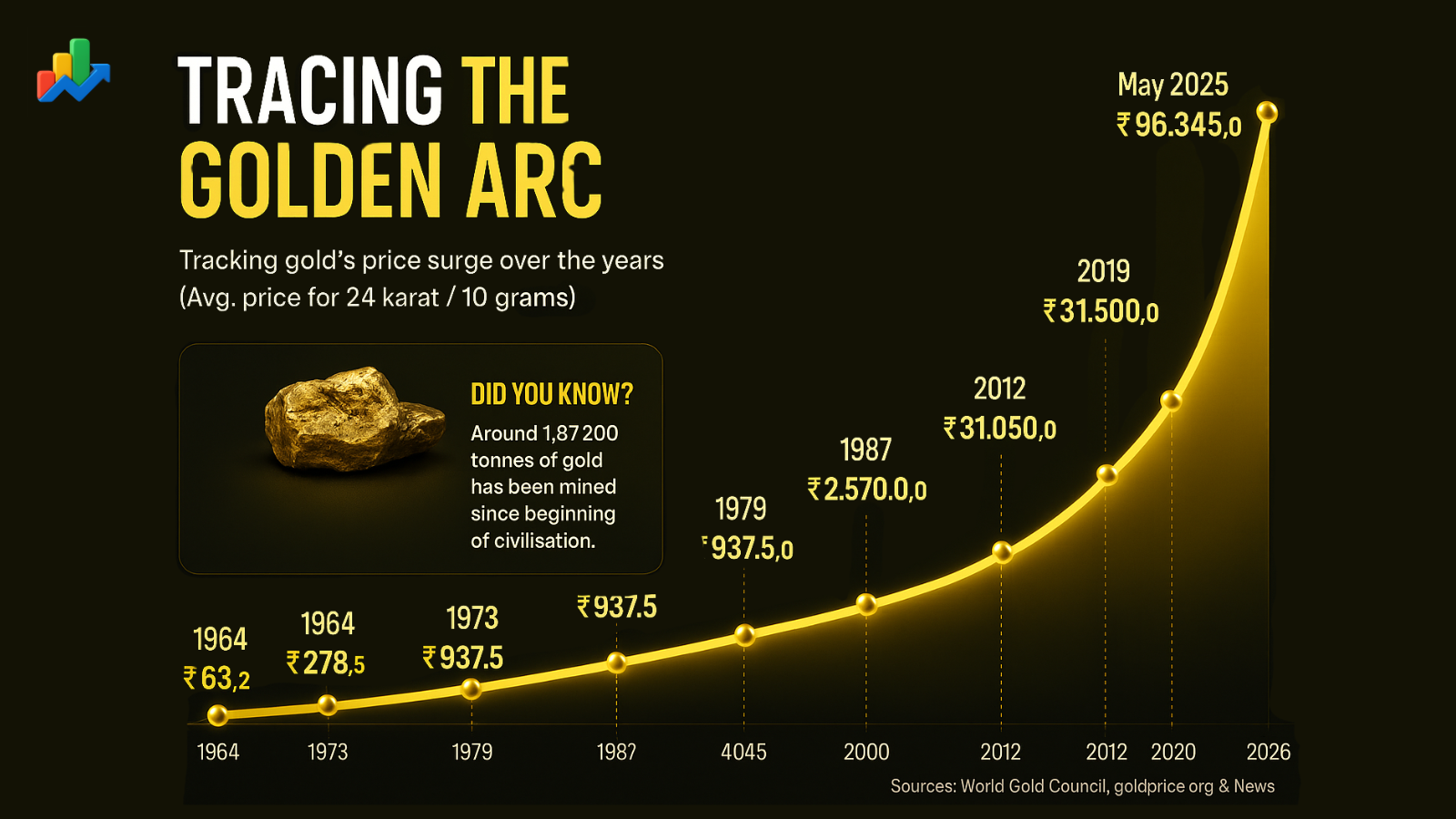

Gold Through the Decades: From ₹63 to ₹96,000

In 1964, 10 grams of 24-karat gold in India cost just ₹63.2. That was a time when India's economy was still finding its footing after independence, and gold was largely seen as ornamental.

By 1973, the global monetary system underwent a significant change — the Bretton Woods Agreement was dismantled, severing the link between the US dollar and gold. This marked the start of free-market gold pricing. In India, the price jumped to ₹278.5. As the Iranian Revolution unfolded in 1979 and oil prices surged, global instability drove gold up to ₹937.5. In 1987, Black Monday — one of the worst stock market crashes in history — caused panic worldwide, pushing gold further to ₹2,570.

After a brief slowdown in the 1990s, triggered by central bank gold sales, prices stabilized around ₹4,045 in 1998. But the 2008 global financial crisis reignited investor interest, and gold prices soared to ₹12,500 as fear gripped global markets. The European debt crisis in 2012 further escalated prices to ₹31,050. As tensions grew in the Middle East in 2019, gold prices climbed to ₹35,220. Then came the pandemic. The COVID-19 outbreak in 2020 dismantled global supply chains, triggered economic lockdowns, and drove investors toward safe havens. Gold surged to ₹48,651. And in May 2025, gold stands at ₹96,345 — its highest ever in Indian history. This recent rally has been supported by increased demand from China, steady central bank buying, and expectations of interest rate cuts by the US Federal Reserve.

The Psychology of Gold Investing

What sets gold apart from most asset classes is not just its performance, but its perception. Across cultures and generations, gold is associated with security, permanence, and value. Even in today’s digital age — where algorithms move billions and cryptocurrencies dominate headlines — the allure of gold remains largely unchanged. Its behavior is often inversely correlated with equities and fiat currencies. When stock markets tumble or inflation eats into purchasing power, gold often becomes the fallback. This consistent investor psychology adds a self-reinforcing element to its demand.

India’s Unique Relationship with Gold

India is one of the largest consumers of gold globally, not just for investment but also for weddings, festivals, and as a symbol of status. According to World Gold Council estimates, Indian households hold over 25,000 tonnes of gold — more than most central banks. In rural India, where access to formal banking is limited, gold often doubles as both ornament and emergency capital. It's liquid, portable, and widely accepted. This deep-rooted demand base gives gold a kind of stability in Indian markets that's hard to replicate with other assets.

Macroeconomic Forces Behind the Rally

Several structural shifts have contributed to gold’s long-term rally:

Currency Devaluation: As central banks across the world printed money post-2008 and during COVID-19, inflation fears drove investors toward gold.

Negative Interest Rates: In parts of Europe and Japan, real interest rates fell below zero, making gold (which pays no interest) more attractive by comparison.

Central Bank Buying: Over the last decade, many central banks — especially those in emerging markets — have increased gold reserves to diversify away from the US dollar.

Geopolitical Tensions: From the Russia-Ukraine conflict to Middle East instability, global political risks have strengthened gold’s appeal as a geopolitical hedge.

These forces, coupled with recurring crises, have built the perfect environment for sustained upward momentum.

The Rarity That Drives Value

A powerful yet often overlooked fact adds to gold’s mystique — only around 1,87,200 tonnes of gold have been mined in all of human history. That entire supply could fit within 3–4 Olympic-sized swimming pools. Its rarity is not just geological — it's economic. With finite supply and gradually increasing demand, gold’s scarcity ensures that its long-term value remains intact. This scarcity narrative continues to support both institutional and retail interest.

Will the Rally Continue?

Gold’s current surge past ₹96,000 raises a natural question: is this the peak or just a pause?

While no prediction is absolute, several tailwinds remain in play:

Ongoing geopolitical uncertainty

High global debt levels and fiscal deficits

Slowing global growth and potential monetary easing

Dollar weakness and de-dollarization movements among emerging markets

Additionally, the rise of gold-backed financial instruments like sovereign gold bonds, digital gold, and ETFs have made gold more accessible, especially to younger investors.

Conclusion: Gold is Not Just an Asset, It’s a Story

Every major spike in gold prices isn’t just about numbers — it tells the story of economic fear, global transition, or a crisis of confidence. As long as uncertainty remains part of our world, gold will continue to play a vital role in portfolios. The "golden arc" we see today is both a chart of prices and a timeline of history — from economic resets to policy revolutions, and from pandemics to central bank decisions. Gold doesn’t just preserve wealth — it reflects it.

Whether you’re a trader, long-term investor, or someone building generational capital — gold deserves its place in your financial strategy.