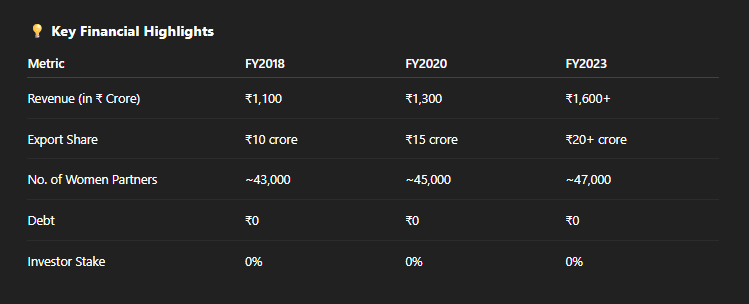

Lijjat Papad isn’t just a household name in India—it’s a model for sustainable, inclusive, and profitable business. Founded by seven women with just ₹80, the Shri Mahila Griha Udyog Lijjat Papad cooperative has turned into a ₹1,600+ crore empire, run entirely by women.

Revenue (FY23): ₹1,600+ crore

Profit Sharing: Profits are equally distributed among all 45,000+ women members.

Assets: Debt-free with self-owned production facilities across 82 branches in India.

Investor Equity: 0% – It’s a completely self-funded cooperative.

Tax Status: Exempt from Income Tax under Section 80P of the Income Tax Act as a cooperative society.

Structure: Cooperative – every woman working is a co-owner, not an employee.

Revenue Source:

Primary: Papads (60–70% revenue share)

Others: Masalas, detergents, agarbattis, pickles, chapatis, and more.

Sales Channels:

Domestic: Distributed through 3,000+ dealers across India

Export: USA, UK, Middle East, Southeast Asia (₹20+ crore export revenue)

Raw Material Sourcing: Centralized procurement of urad dal, spices, packaging—helping reduce costs with scale.

Labor Cost: Daily wages, but considered “profit share,” not salary—remains flexible and performance-based.

Fixed Costs: Almost negligible; operates from member homes and low-cost facilities.

No Advertisement: Growth is purely word-of-mouth and distributor push.

Reinvestment: Entire surplus is reinvested or distributed as bonuses—no dividends to outsiders.

Sustainability: Solar dryers, handmade processes, minimal machine dependency.

Digital Shift: Some modernization in packaging, quality control, and accounting—still retains human-first processes.

No Debt, No Investors, No Advertising

High Return on Community Investment – Every rupee of profit empowers women directly.

Profit Sharing Model – Ensures motivation, retention, and performance without capitalistic pressure.

Lijjat Papad stands as a rare financial success story—run by women, for women, with zero external capital. It proves that inclusive capitalism can be sustainable, ethical, and scalable. The ₹80 seed money has transformed into a multi-crore cooperative, not by chance, but by discipline, transparency, and vision.