From Tobacco Giant to Diversified Powerhouse: Unpacking ITC's Remarkable Transformation

What's Happening?

ITC, long known as a tobacco giant, has quietly and strategically rewritten its story. As of 2024, it stands as the 11th-largest listed company in India with a market capitalization of ₹5.2 lakh crore. While cigarettes still form a large chunk of its revenue, the company has built powerful verticals in FMCG, hospitality, agri-business, packaging, IT, and sustainability — a diversification blueprint rarely seen at this scale in India.

From Imperial Tobacco to ITC Limited:

ITC’s journey began over a century ago, in 1910, as the Imperial Tobacco Company of India Limited, focused purely on cigarette manufacturing. It evolved to India Tobacco Company in 1970 and was rechristened ITC Limited in 1974, symbolizing its intent to go beyond tobacco. A major strategic decision came when the company shifted its headquarters from Kolkata to Delhi, aimed at sharpening its marketing capabilities and overall reach, laying the foundation for its future.

The Cigarette Stronghold That Funded Everything Else:

Even today, cigarettes account for about 42% of ITC’s total revenue, with an estimated 80% share of India’s cigarette market. ITC used this powerful cash engine to build out other businesses. Its tobacco distribution network, spanning over 15 lakh retailers, gave ITC an edge when it expanded into FMCG, allowing it to launch and distribute products nationwide without heavy investment in new supply chains.

Stepping into Hospitality:

The 1970s marked the beginning of ITC’s diversification. In 1975, it launched its first hotel, Hotel Chola, in Chennai. Today, ITC is the third-largest hotel chain in India with over 100 properties, offering luxury while embedding sustainability at its core. Hotels like ITC Gardenia in Bengaluru, ITC Grand Chola in Chennai, and ITC Maratha in Mumbai are all LEED Platinum certified. The hotel business, though once a capital guzzler, has now been de-merged to streamline financials and unlock further value.

The FMCG Playbook:

While cigarettes funded operations, FMCG was always the dream. In the early 2000s, the company ventured into packaged foods, personal care, and stationery, competing against entrenched players. Today, ITC's portfolio includes Aashirvaad (India’s top flour brand), Bingo snacks, Yippee noodles, Sunfeast biscuits and pasta, Savlon, Fiama, and Classmate notebooks. The speed at which these brands scaled is remarkable, with its ready-to-eat segment now second only to MTR Foods. ITC has launched an average of 20 new FMCG products annually in recent years, showcasing a consistent innovation pipeline.

Strategy: Focused, Silent, Long-Term:

ITC’s leadership, especially under Y.C. Deveshwar (1996 to 2017), adopted a long-term view. Recognizing growing scrutiny around tobacco, they actively diversified into food, agri, hospitality, and digital services. In the late 1990s, ITC exited non-core areas, focusing on businesses aligned with its existing competencies and societal impact. PR remained minimal; ITC preferred execution over headlines, even as investors remained skeptical.

Empowering Rural India:

Perhaps ITC’s most impactful initiative was launched in 2000 – the e-Choupal platform. This platform gave over 4 million farmers across 35,000 villages access to real-time market prices, weather forecasts, and digital education. It was a rare case of a corporation meaningfully empowering rural India while strengthening its agri-commodity supply chain. Its agri business division, started in 1990, is today one of the country’s largest agri-commodity exporters.

Packaging and Paper with Purpose:

Another vital pillar is ITC’s Paperboards & Specialty Papers Division, providing sustainable packaging solutions. As demand for eco-friendly packaging grows, ITC is well-positioned with recyclable and biodegradable alternatives, a competitive advantage built years before it became a trend.

Green Credentials:

ITC has been a front-runner in ESG goals, being carbon-positive for over 18 years, water-positive for 21 years, and solid waste recycling-positive for 16 years. Half of its total energy needs are met through renewable sources. Its ‘Well-being Out of Waste’ (WOW) program has sensitized over 2.5 crore people. These reflect deep integration of sustainability into ITC’s DNA.

The Digital Arm: ITC Infotech:

Set up in 2000, ITC Infotech has emerged as a global IT services player, operating in over 50 countries. Though not as large as India’s IT majors, ITC Infotech plays a strategic role, digitizing internal processes while creating external revenue streams.

Dipping into Indian Luxury:

Few associate ITC with luxury, but Fabelle Trinity Truffles, priced at ₹4.3 lakh per kg and a Guinness World Record holder, showcases ITC’s ambition to build Indian brands that can compete with global luxury.

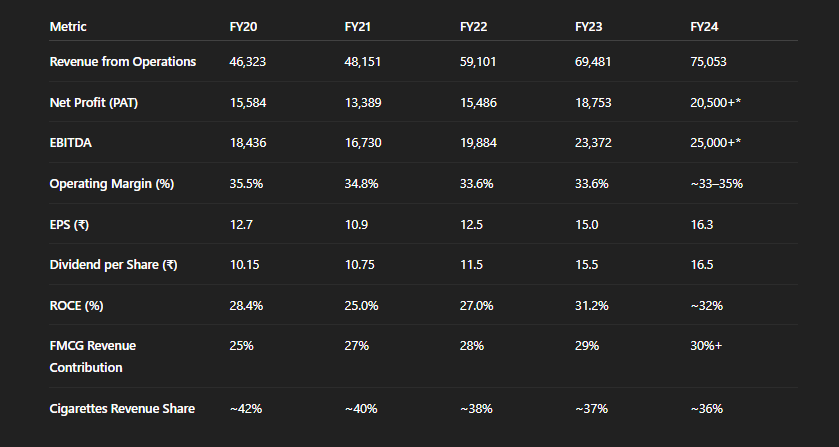

Financial Snapshot (as of 2024):

Leadership under Sanjiv Puri:

Sanjiv Puri, who took over as Chairman and MD in 2019, has continued Deveshwar’s vision — doubling down on digital transformation and sustainability. His appointment as CII (Confederation of Indian Industry) President for 2024–25 is a significant reflection of ITC’s rising influence in corporate and policy circles. (Note: Current date is June 11, 2025, so his CII Presidency for 2024-25 would have concluded or be nearing its end).

The Evolving Perception of ITC:

For investors, ITC’s slow stock price movement over the years may have been frustrating. However, beneath the surface, the company has been quietly reshaping itself. It has successfully spread its wings far beyond tobacco, building an empire with resilience, diversification, and sustainability at its core.

A Story Beyond Cigarettes:

ITC is no longer just a cigarette stock. It embodies a story of long-term strategic thinking, operational excellence, impactful rural empowerment through initiatives like e-Choupal, and understated execution. This multifaceted narrative of transformation and growth is far from over, suggesting continued evolution and expansion in the years to come.