As an economy that imports approximately 85% of its crude oil needs, India is inherently sensitive to oil price shocks. The macroeconomic ramifications of a significant and sustained increase in crude prices are multifaceted:

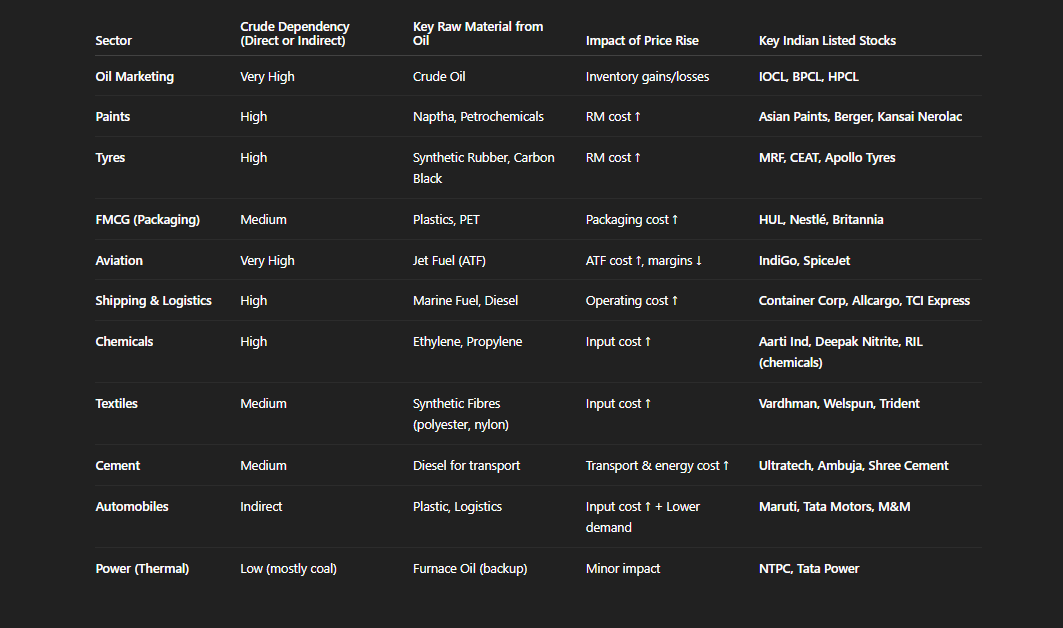

The degree to which various Indian industries are impacted by crude oil price fluctuations depends on their direct or indirect dependency on crude oil or its derivatives.

Estimated Crude Oil Use per Sector in India (approximate share of total crude use):

While most sectors face headwinds from higher crude prices, a few stand to benefit:

Short-Term (0–3 months):

Mid-Term (3–6 months):

Defensive/Beneficiaries:

Vulnerable:

India's economic resilience has been a consistent theme, with robust GDP growth projections (6.3-6.8% for FY26 by various agencies) and strong domestic demand. However, a prolonged crude oil price spike, particularly stemming from Middle East instability, presents a formidable challenge. It would undoubtedly: